The Arctic Awakening: Greenland's Energy Revolution and What It Means for Denmark in 2026

The Arctic Awakening: Greenland's Energy Revolution and What It Means for Denmark in 2026

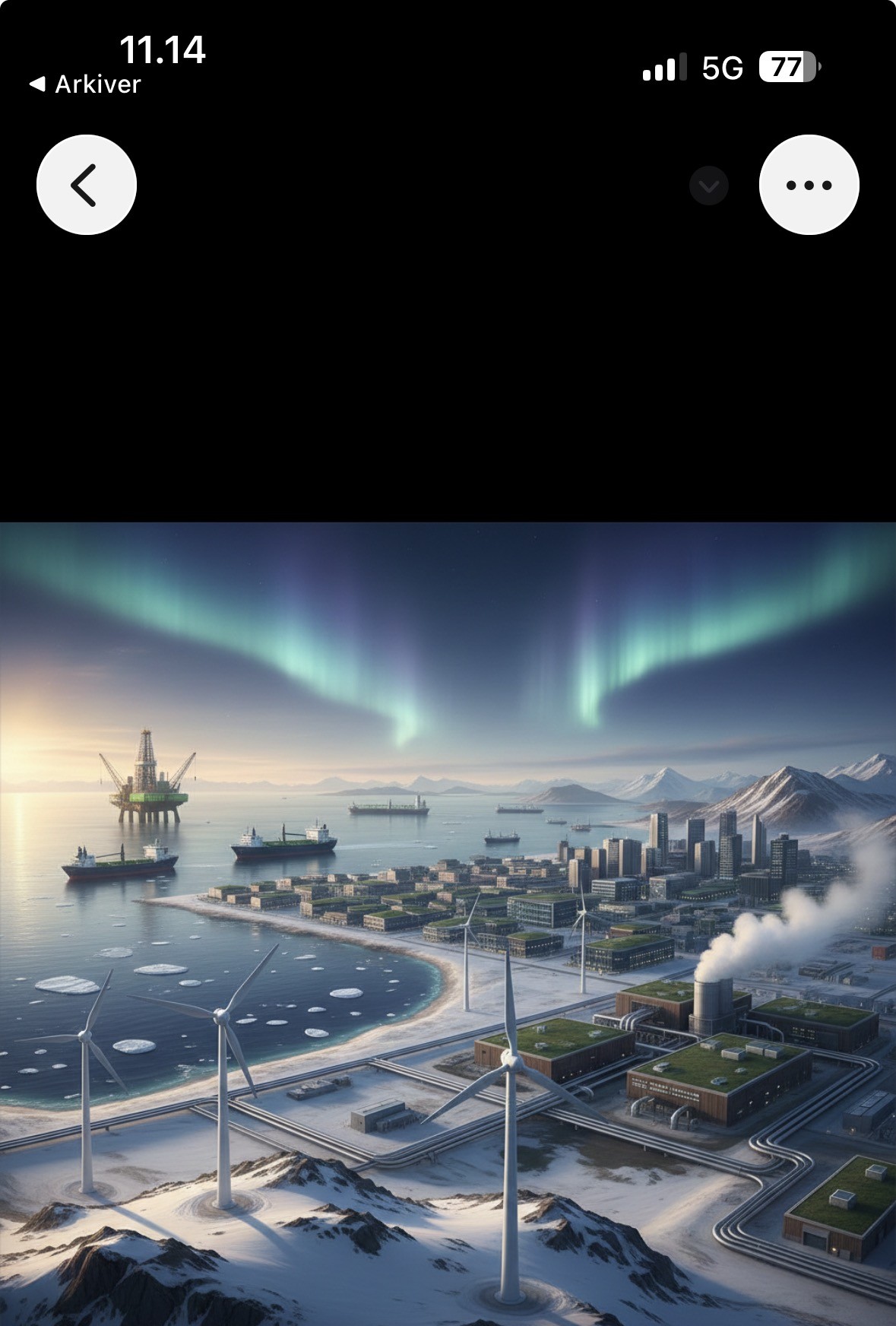

The ice is melting in Greenland, but that's not the only transformation underway. As we move deeper into 2026, the world's largest island is experiencing an energy and resources revolution that's reshaping geopolitics, creating unprecedented business opportunities, and testing the bonds of the Kingdom of Denmark in ways few could have predicted even five years ago. For Danish industry, energy strategists, and anyone watching the global transition to clean energy, Greenland has moved from the periphery to center stage in a remarkably short time.

This isn't your grandfather's Greenland story. We're not talking about distant fishing villages or the gradual retreat of glaciers. We're talking about multi-gigawatt hydropower projects, rare earth mining operations that could reshape global supply chains, green ammonia production that could fuel transcontinental shipping, and a geopolitical chess game involving Washington, Beijing, and Copenhagen that would make Cold War strategists dizzy. If you're in the Danish energy sector and you're not paying attention to Greenland right now, you're missing the biggest opportunity—and the biggest challenge—of the decade.

The New Arctic Reality: Why 2026 Changes Everything

Let's start with the fundamental shift that's occurred. Greenland is no longer a peripheral icy frontier sustained by Danish subsidies and fishing quotas. It has become one of the most strategically significant pieces of real estate on the planet, and everyone from the White House to the European Commission to Chinese state-owned enterprises is taking notice.

The numbers tell part of the story. Greenland holds at least 25 of the 34 materials that the European Union has classified as critical for the green transition. Its theoretical hydropower potential exceeds 18 gigawatts—enough to power several major European nations. The island sits on rare earth deposits that could break China's near-monopoly on these essential materials. And its geographic position on the Great Circle shipping routes between North America and Europe makes it a natural logistics hub as Arctic ice continues to recede.

But numbers alone don't capture what's happening. The real story is about sovereignty, security, and the fundamental recalibration of how Greenland sees itself and how the world sees Greenland. The Greenlandic government, the Naalakkersuisut, is no longer content to be a dependent territory. It's leveraging its resource wealth to chart a path toward economic independence from the Danish block grant—the annual subsidy that has defined the relationship between Nuuk and Copenhagen for decades.

For Danish businesses, this creates both tremendous opportunity and genuine complexity. The era of Danish companies simply showing up as contractors to service Greenlandic infrastructure is evolving into something more nuanced. Success now requires real partnership, genuine technology transfer, and a deep understanding of Greenlandic political sensitivities that go far beyond traditional business considerations.

The Geopolitical Pressure Cooker: Trump, China, and the New Arctic Great Game

If you've been following international news in early 2026, you've likely seen the headlines. The renewed Trump administration in Washington has not been subtle about its interest in Greenland. Following the dramatic U.S. capture of Venezuelan leadership in early January 2026, President Trump has returned to his 2019 theme of Greenland "ownership and control," but this time with a more sophisticated strategy and a policy framework he's calling "Energy Realism."

The appointment of Jeff Landry as a Special Envoy to Greenland in January 2026 represents more than diplomatic posturing. It signals that the United States is moving beyond maintaining a consular presence in Nuuk toward active industrial engagement. Washington's strategic goal is transparent: to decouple Greenland's mineral wealth from Chinese processing chains and ensure that critical materials flow into Western—preferably American—supply chains.

Why does this matter for Danish businesses? Because it creates both opportunities and risks that didn't exist even a year ago. On one hand, U.S. government financing mechanisms, including the Export-Import Bank, are suddenly available for Greenlandic resource projects in ways they haven't been before. The potential for American capital to flow into Greenlandic mining and energy projects is enormous, and Danish firms with the right expertise can position themselves as essential partners in these ventures.

On the other hand, this geopolitical attention creates volatility and pressure. The relationship between Nuuk and Copenhagen is being tested in new ways as Greenlandic politicians increasingly view their resource wealth not just as a path to economic freedom, but as a bargaining chip in a high-stakes negotiation over security arrangements. Some voices in Greenland are openly discussing whether closer security ties with the United States could accelerate the path to full independence from Denmark.

The Chinese dimension adds another layer of complexity. Beijing has been actively courting Greenland for over a decade, offering infrastructure financing and promising to purchase whatever resources Greenland wants to sell. While Greenlandic governments have generally been cautious about Chinese investment—particularly after Denmark and the U.S. successfully lobbied against Chinese financing for the new airports—the option remains on the table as leverage in negotiations with Western partners.

For Danish companies, the strategic imperative is clear: position yourselves as the "trusted third party." Danish firms that can help Greenland develop its resources while maintaining sovereignty, meeting Western security requirements, and providing genuine technology transfer and local employment have a unique role to play. This is Denmark's competitive advantage in the new Arctic—not just technical expertise, but trust built over centuries of shared history, even if that history is complicated.

Hydropower Renaissance: From Village Electricity to Industrial Scale

For decades, Greenland's hydropower development focused on replacing diesel generators in small settlements. The iconic Buksefjord plant near Nuuk, with its modest 45 megawatts of capacity, has been the flagship of Greenlandic renewable energy. That era is ending, and what's replacing it is almost unfathomable in scale.

The headline development for 2026 is the opening of public tender rounds for Greenland's two largest mapped hydropower sites: Tasersiaq and Tarsartuup Tasersua. Let's be clear about the magnitude here. Combined, these sites could produce over 9,500 gigawatt-hours annually. To put that in perspective, that's roughly equivalent to the annual electricity consumption of a country like Denmark itself. This isn't about powering villages anymore; this is industrial-scale energy that could transform Greenland's entire economic model.

The Greenlandic government has been explicit about its intentions for this power. Unlike previous small-scale hydroelectric projects designed primarily for local consumption, these massive developments are being positioned for heavy industry offtake. And the industrial interest is coming from two somewhat unexpected directions that tell us a lot about where global energy markets are heading.

First, there's the green steel and metals smelting sector. European industrial giants are desperately seeking zero-carbon energy for electrolysis and smelting processes as carbon border adjustments and emissions trading systems make traditional coal-powered metallurgy increasingly uneconomical. Greenland's abundant hydropower, far from emission-intensive grids, offers a genuine solution. The ability to produce steel, aluminum, or other metals with electricity generated from renewable sources in Greenland and then export those materials to European markets without carbon penalties is an increasingly attractive proposition.

Second—and this one raises eyebrows in some quarters—there's what some are calling the "digital gold rush." The year 2026 has seen an unexpected surge in interest from cryptocurrency mining operations and artificial intelligence data centers looking to locate in Greenland. The business logic is straightforward, even if the environmental politics are complicated. One megawatt of power in Greenland's naturally cold environment is roughly 20 percent more efficient than the same megawatt in continental Europe, because cooling requirements—one of the biggest expenses for data centers and mining rigs—are dramatically reduced when the ambient temperature is near freezing much of the year.

The Greenlandic government is approaching these "digital industry" proposals with caution. There's understandable concern about using precious renewable energy to mint Bitcoin rather than to decarbonize essential industries or power local communities. But the economic reality is that these operations offer constant, predictable baseload demand that makes large hydropower projects more financeable. A mining company or an aluminum smelter might negotiate power purchase agreements measured in decades; a data center operator offers similarly long-term commitments, turning what might otherwise be stranded energy assets into bankable projects.

The Buksefjord 3 expansion project near Nuuk represents the bridge between the old model and the new. The planned expansion from 45 megawatts to 121 megawatts, with construction beginning in 2026, is the largest civil engineering project in Greenlandic history. The European Investment Bank has positioned itself at the front of the financing queue, and Danish engineering consultancies—particularly NIRAS and Ramboll—are already winning contracts for the complex work of drilling 16-kilometer transfer tunnels through granite mountains.

For Danish civil engineers, this is the project of the decade. But it's also the proof-of-concept that will determine whether even larger projects move forward. If Buksefjord 3 comes in on time and on budget, demonstrating that Denmark-Greenland partnerships can deliver major infrastructure in Arctic conditions, the floodgates open for the truly massive developments. If it encounters the kind of delays and cost overruns that have plagued other remote infrastructure projects, investors will think twice about the gigawatt-scale proposals.

Power-to-X: The Green Ammonia Export Strategy

While Denmark's domestic Power-to-X strategy focuses on projects like the HØST facility in Esbjerg, Greenland offers something Denmark fundamentally lacks: scale. Denmark is a small, densely populated country where every square kilometer is spoken for and where large-scale industrial development faces both land constraints and local opposition. Greenland has the opposite problem—vast expanses of land and abundant renewable energy, but limited local demand and significant logistical challenges.

This is where the Power-to-X opportunity becomes fascinating. The global shipping industry faces a brutal reality: by 2030, new regulations will effectively require a massive shift away from conventional marine fuels. The most promising alternatives—green methanol and green ammonia produced using renewable electricity—are still expensive to produce and challenging to distribute. Greenland's combination of abundant hydropower and strategic location on North Atlantic shipping routes creates a unique proposition.

Imagine a future—and it's not as distant as you might think—where container ships traveling between North America and Europe stop in Greenlandic ports to refuel with ammonia produced in fjordside plants powered by local hydropower. The ships themselves are increasingly being designed to run on ammonia fuel, avoiding the need for further conversion. The ammonia is produced on-site using electrolyzers that split water into hydrogen and oxygen, then combining that hydrogen with nitrogen extracted from the air. The entire process runs on renewable electricity and produces zero carbon emissions.

Danish companies are at the forefront of making this vision real. Haldor Topsøe, the Danish catalyst and process technology company, is currently evaluating modular Power-to-X units specifically designed for remote Arctic deployment. These aren't massive industrial complexes requiring years of construction; they're factory-built modules that can be shipped to Greenlandic fjords, connected to local hydropower, and begin producing green ammonia within months rather than years.

Ørsted, Denmark's renewable energy giant, is also exploring Greenlandic opportunities, though their focus has historically been offshore wind rather than hydropower. The key insight is that the Power-to-X technology doesn't care where the renewable electricity comes from—wind, hydro, or solar all work equally well for electrolysis. What matters is the cost and reliability of the power, and on both counts, Greenland's hydropower is competitive.

The primary challenge—and it's substantial—is what industry insiders call the "Arctic Premium." Building and operating industrial facilities in Greenland costs roughly 40 percent more than similar facilities in more temperate climates. Logistics are more complex, the construction season is shorter, equipment must be rated for extreme cold, and labor costs are higher because many skilled workers must be flown in from Denmark or other countries.

However, the economics are shifting rapidly in Greenland's favor. The European Union's Carbon Border Adjustment Mechanism, now fully operational in 2026, fundamentally changes the competitive landscape. Suddenly, carbon-zero molecules produced in Greenland using renewable electricity are price-competitive with "grey" hydrogen or "brown" ammonia produced in regions with cheap fossil fuels but high carbon intensity. When you add the carbon price to the production cost of conventionally produced ammonia, Greenland's green molecules start looking remarkably attractive.

There's also a security dimension that's becoming increasingly important. European energy security concerns, heightened by recent geopolitical tensions, are driving interest in domestic or allied production of critical energy carriers. Green ammonia from Greenland, a part of the Kingdom of Denmark and firmly within the Western alliance, is inherently more secure than imports from regions with less stable political relationships.

Critical Raw Materials: The Battle for What's Beneath the Ice

If hydropower and Power-to-X are about what Greenland can produce with its renewable resources, the critical materials story is about what lies beneath the bedrock. And what lies there could reshape global supply chains in ways that have profound implications for everything from electric vehicles to wind turbines to defense systems.

Greenland holds at least 25 of the 34 materials that the European Union has designated as critical—materials that are essential for the green transition and for which Europe currently depends heavily on imports, particularly from China. This isn't theoretical geology; these are confirmed deposits, some of which are already moving toward production.

Tanbreez: The Western World's Rare Earth Hope

The Tanbreez rare earth project in South Greenland is arguably the most strategically significant mining development in the Western world right now. Rare earth elements are absolutely essential for modern technology—they're in the permanent magnets of electric vehicle motors and wind turbine generators, in the displays of smartphones and computers, in defense systems and precision-guided munitions. And currently, China controls roughly 90 percent of global rare earth processing capacity, even for minerals mined elsewhere.

Tanbreez changes this equation. In 2025, the project completed its Preliminary Economic Assessment, demonstrating economic viability under current market conditions. In early 2026, it stands as the only major rare earth project in Greenland with an exploitation license that doesn't face the political complications of associated uranium deposits—more on that challenge shortly.

The strategic significance hasn't been lost on Washington. The U.S. Export-Import Bank is currently reviewing what would be the first multi-billion dollar loan for an overseas mining project under the Trump administration's executive orders prioritizing critical mineral security. If that financing comes through—and informed observers think it will—Tanbreez could be in production within three to four years, providing a Western alternative to Chinese rare earth processing for the first time in decades.

For Danish companies, Tanbreez represents multiple opportunities. The engineering required to extract and process rare earth ores in Arctic conditions is extraordinarily complex. The ore must be crushed, concentrated, and then subjected to hydrometallurgical or pyrometallurgical processing to separate the individual elements. Danish expertise in process engineering, environmental controls, and cold-climate construction is directly relevant. Moreover, Danish shipping and logistics companies have obvious roles in transporting concentrates or finished products to processing facilities or end markets.

Malmbjerg: The Molybdenum Essential

While rare earths get most of the headlines, molybdenum might be equally important for European industrial security. This silvery metal is essential for high-strength steels used in everything from oil and gas pipelines to wind turbine towers to armor plating. It's also critical for certain chemical catalysts and for high-temperature applications in aerospace and defense.

The Malmbjerg molybdenum project in East Greenland, being advanced by Greenland Resources Inc., is one of the world's largest undeveloped molybdenum deposits. The scale is remarkable—this single mine could potentially provide up to 25 percent of the European Union's total molybdenum requirements. For Danish steel manufacturers and defense contractors, securing long-term offtake agreements from Malmbjerg isn't just good business; it's a matter of supply security.

The challenge, as with all Greenlandic mining projects, is the logistics. Malmbjerg is in one of the most remote regions of Greenland, accessible only by sea during the brief ice-free summer months. Everything—equipment, supplies, fuel, workers—must be moved during a narrow window, and operations must be designed to function autonomously during the long winter when resupply is impossible. This is where Danish Arctic expertise, developed over decades of supporting remote communities and research stations, becomes invaluable.

The Uranium Question: Politics and Multi-Billion Dollar Lawsuits

Not all resource development stories in Greenland have happy endings, and the uranium saga is a cautionary tale that every Danish company considering Greenlandic ventures needs to understand.

In 2021, the Inuit Ataqatigiit party won Greenland's parliamentary elections on a platform that included a strict ban on uranium mining. This wasn't just environmental policy; it was about Greenlandic identity and self-determination. The Inuit communities have long memories of the Cold War era when Denmark and the United States conducted uranium exploration in Greenland without meaningful consultation with local populations. The uranium ban was as much about asserting Greenlandic control over their own resources as it was about environmental protection.

The problem? Several advanced mining projects in Greenland contain uranium as a byproduct. The most notable is the Kvanefjeld rare earth deposit, which was being developed by Australian company Energy Transition Minerals (formerly Greenland Minerals). With uranium present in the ore, the project became legally impossible to advance after the 2021 ban.

The result? Energy Transition Minerals is currently suing the Greenlandic and Danish governments for 76 billion Danish kroner in international arbitration courts. The case is ongoing in 2026, and regardless of the legal outcome, it illustrates a fundamental truth about doing business in Greenland: social license to operate matters more than legal mining rights. A project that doesn't respect Greenlandic political sensitivities and environmental values will face insurmountable obstacles, regardless of its technical or economic merits.

For Danish companies, the lesson is clear. Due diligence in Greenland must include not just geological and economic analysis, but deep engagement with Greenlandic communities and understanding of local political dynamics. The "zero uranium" ethos isn't going to change anytime soon, and projects that include uranium-bearing deposits are simply not viable, no matter how valuable the other minerals might be.

Infrastructure Revolution: Why 2026 Is Different

One of the biggest obstacles to Greenlandic development has always been infrastructure—or the lack thereof. There are no roads connecting Greenland's towns; everything moves by boat or airplane. Internet connectivity was slow and expensive. Getting people and equipment to remote sites required elaborate logistics chains with multiple transfers and weather-dependent schedules.

Much of this changed in 2025 and early 2026, fundamentally altering the economics of Greenlandic operations.

The Airport Game-Changer

The full operational launch of the new international airports in Nuuk and Ilulissat in 2025/2026 represents perhaps the single most important infrastructure development in modern Greenlandic history. Previously, nearly all international traffic had to route through Kangerlussuaq, a former U.S. Air Force base with a long runway but minimal facilities, located in the middle of nowhere. Travelers then had to take smaller aircraft to reach their final destinations—a process that could add days to trips and dramatically increased costs.

Now, direct flights operate from Copenhagen to Nuuk in approximately 4.5 hours. For Danish companies, this changes everything. Engineering teams can now reach Greenland's capital for site visits or project oversight with the same ease as traveling to other European cities. The "Kangerlussuaq bottleneck" is gone, and with it, a major source of delays and expense.

The ripple effects go beyond simple convenience. The new airports make regular FIFO (fly-in, fly-out) rotational workforce arrangements viable in ways they weren't before. While there's strong political pressure to employ Greenlandic workers—more on that shortly—some specialized roles will always require workers from Denmark or elsewhere. The new airports make rotating these workers in and out on reasonable schedules possible, improving both cost-effectiveness and worker satisfaction.

The airports also make emergency medical evacuation and emergency equipment delivery far more reliable. For companies operating in remote areas, knowing that critical parts can reach Nuuk from Copenhagen in hours rather than days reduces project risk and insurance costs. These might seem like small details, but in Arctic operations, logistics reliability often determines project success or failure.

The Digital Revolution: Fiber Optics Meet the Arctic

Less visible but equally important is Greenland's digital infrastructure revolution. The completion of the Leif Erikson subsea fiber optic cable system in late 2025 has transformed Greenland's connectivity to the outside world. Previously, Greenland relied on a single aging cable system with limited bandwidth and frequent outages. Now, multiple modern fiber systems connect Greenland to both North America and Europe, with bandwidth capacity that would have seemed impossible just a few years ago.

For energy and mining operations, this connectivity enables something that's becoming standard in modern industrial projects: remote operations centers. A Danish engineering firm can now monitor the structural integrity of a hydroelectric dam in East Greenland or control autonomous mining equipment from an operations center in Aarhus with minimal latency. The video feeds are clear, the data transmission is reliable, and the decision-making loop between Greenland and Denmark can operate in near-real-time.

This connectivity also makes the aforementioned data center and cryptocurrency mining proposals viable. These operations require constant, reliable, high-bandwidth connections to global networks. Without the new fiber systems, they simply couldn't function in Greenland. Now they can, creating the "baseload demand" for electricity that helps justify large hydropower developments.

There's a broader benefit too: grid intelligence. Modern electricity grids increasingly rely on sophisticated monitoring and control systems to balance variable renewable generation, manage demand response, and maintain stability. These "smart grid" systems require real-time data communication between generation assets, storage systems, and load centers. Danish companies like Kamstrup, a global leader in intelligent metering, and Danfoss, which produces advanced grid control systems, are now deploying Arctic-rated equipment in Greenland that simply couldn't have functioned with the old connectivity infrastructure.

Navigating the Arctic Premium: The Real Economics of Remote Operations

The single biggest challenge for anyone operating in Greenland isn't the cold, the ice, or even the distance from markets. It's the "Arctic Premium"—the collection of additional costs that make everything more expensive than it would be in temperate climates.

Understanding and managing this premium is the difference between successful Greenlandic ventures and expensive failures. Let's break down what it actually means in practice.

The Shipping Season: A Brutal Constraint

Despite climate change and retreating sea ice, Greenland's northern and eastern coasts still experience significant ice coverage for much of the year. For heavy sealift—the large cargo ships needed to deliver major equipment like turbines, transformers, or mining machinery—there's a limited window of ice-free access, typically running from late June through October.

This creates a logistical pressure cooker. If you're building a hydroelectric plant in East Greenland, every single major component must be manufactured, staged at a port in Denmark or Iceland, and then shipped during that narrow window. Miss the window, and your equipment sits in storage for ten months, racking up carrying costs and delaying your project by a full year.

The 2026 best practice that's emerging among successful projects is what industry insiders call "staging and sprint." Equipment is manufactured during the winter, fully tested and commissioned at the factory, and then pre-positioned at ice-free ports (often Reykjavik in Iceland) weeks before the shipping season opens. The moment ice conditions allow, vessels make rapid deliveries to Greenland, where prearranged crews are ready to immediately off-load and install. This compressed timeline requires military-precision logistics but minimizes the risk of seasonal delays.

Danish construction and engineering firms are becoming global leaders in "modularization" as a response to these constraints. Rather than building facilities on-site from individual components—which would require multiple shipping seasons and expose the project to Arctic weather for extended periods—modern Arctic projects increasingly use pre-assembled modules. These might be complete electrolyzer units for hydrogen production, pre-fabricated accommodation blocks for workers, or entire processing plants built in sections at Danish shipyards.

The modules are tested comprehensively before shipping. When they arrive in Greenland, they're craned onto pre-built foundations and connected to utilities, a process that might take days rather than months. This approach dramatically reduces the time crews must work in Arctic conditions and increases the likelihood of completing projects within single construction seasons.

The Workforce Challenge: Local Training vs. Imported Expertise

Here's a political and practical challenge that Danish companies must navigate carefully: the Greenlandic government increasingly requires that significant percentages of project workforces be Greenlandic citizens or permanent residents.

This isn't arbitrary protectionism. It's fundamental to Greenland's development strategy. Resource projects that simply fly in foreign workers, extract resources, and fly those workers back out provide minimal benefit to Greenlandic communities. There's no skills transfer, limited local economic impact beyond taxes and royalties, and the projects can actually exacerbate social problems by creating a two-tier system where imported workers earn far more than locals for similar work.

The emerging standard is what's called the "25 percent rule"—many new licenses and contracts require that at least 25 percent of the workforce be local. For some roles, this is straightforward. General labor, basic operations, and many maintenance functions can be performed by Greenlandic workers after appropriate training. But specialized roles—say, tunnel boring machine operators, high-voltage electrical engineers, or metallurgical experts—require years of training and experience that simply doesn't exist in Greenland's small population.

The Danish solution that's proving successful is genuine partnership with Greenlandic educational institutions. Danish vocational training providers are establishing satellite campuses or partnership programs with institutions like the Sisimiut Technical College. Young Greenlandic workers receive training in Denmark or from Danish instructors in Greenland, gaining certifications in wind turbine maintenance, hydrogen safety systems, mining equipment operation, or grid management.

This approach serves multiple purposes. It helps Danish companies meet their local employment obligations. It builds the long-term human capital that Greenland will need for economic independence. And it creates genuine goodwill and social license that protects projects from political opposition. A hydropower project that's training dozens of Greenlandic engineers and technicians is far less likely to face local resistance than one that imports its entire workforce.

The labor economics are also evolving in interesting ways. While Greenlandic workers may require initial training, they command lower salaries than Danish or other expatriate workers, and they don't require expensive FIFO rotation logistics. As the local workforce becomes more skilled, the cost advantage increases. Projects that invest in training during their early phases often see their workforce costs actually decrease over time, offsetting some of the Arctic premium.

The Financial and Legal Framework: What Danish Companies Must Know

Greenland's evolution toward greater autonomy is creating a more sophisticated regulatory and financial environment. For Danish CFOs and legal teams, understanding these frameworks isn't optional—it's essential for managing risk and structuring successful investments.

The Mineral Resources Act: From Extraction to Value-Addition

The updated Greenlandic Mineral Resources Act, with its 2024 amendments, reflects a fundamental shift in how Greenland views resource development. The government is no longer interested in simple extraction—dig up ore, ship it overseas, collect a royalty. The new emphasis is on "value addition," meaning processing and beneficiation should happen in Greenland whenever technically and economically feasible.

This creates both challenges and opportunities for Danish firms. On the challenge side, it means that simple mining-and-shipping models are increasingly difficult to license. A proposal to mine rare earth ores and immediately export concentrates to China for processing will face far more skepticism than a proposal that includes building separation facilities in Greenland, even if those facilities are more expensive to construct and operate.

On the opportunity side, this plays directly into Danish strengths. Denmark has world-class expertise in green chemistry, sustainable processing technologies, and environmental engineering. Danish firms specializing in ore beneficiation, metals recovery, or chemical processing have a natural advantage over Australian or Canadian mining companies whose business model is pure extraction.

The key is to structure projects from the beginning with Greenlandic value-addition as a core component, not an afterthought. This might mean planning for a two-phase development where initial operations export concentrates while the second phase builds local processing capacity. It might mean partnering with Greenlandic entities to operate processing facilities even if the mining operation is foreign-owned. The specific approach varies by project, but the principle is constant: demonstrate clear plans for creating value in Greenland, not just extracting it.

Taxation, Royalties, and the Double Taxation Treaty

The Greenlandic corporate tax environment in 2026 is actually more favorable than many investors expect. The standard corporate tax rate is 25 percent, in line with Denmark and competitive with other Nordic jurisdictions. But the real story is in the investment incentives and credits available for projects that align with Greenlandic priorities.

Green energy projects—particularly those involving renewable electricity generation or green hydrogen/ammonia production—can access significant investment tax credits that effectively reduce the tax burden during the initial years of operation when cash flows are tight. These aren't automatic; they require demonstrating that the project meets sustainability criteria and provides clear benefits to Greenland. But for well-structured projects, the tax incentives can be substantial.

The Double Taxation Treaty between Denmark and Greenland remains a cornerstone of the economic relationship and a key advantage for Danish firms. Profits earned by Danish companies in Greenland aren't subject to double taxation when repatriated to Denmark, and losses in Greenlandic operations can often be offset against Danish tax obligations under certain conditions. This framework reduces the financial risk of Greenlandic investments for Danish firms and makes it easier to justify board-level commitments to Arctic ventures.

Royalty structures vary by resource and project scale, but there's increasing flexibility in how royalties are structured. Rather than simple ad valorem royalties (a percentage of revenue), newer agreements often include profit-sharing arrangements that align government and company interests. When commodity prices are high and projects are profitable, the government shares in that upside. When prices are low and projects struggle, the royalty burden decreases, improving project resilience.

ESG: The Greenland Standard

If you think ESG (Environmental, Social, and Governance) scrutiny is intense in Europe, Greenland takes it to another level. Projects are now subject to what might be the most rigorous environmental and social assessments anywhere in the world, and for good reason. The Arctic environment is extraordinarily fragile, with ecosystems that can take decades or centuries to recover from disturbance. And Greenlandic communities maintain traditional hunting and fishing practices that require pristine natural environments.

For Danish pension funds—entities like PFA or ATP that are increasingly important sources of capital for large infrastructure projects—the Greenland ESG standard is actually reassuring. These institutions face intense pressure from their members and regulators to ensure investments don't contribute to environmental degradation or social harm. A project that passes Greenlandic environmental review is almost certainly compliant with European ESG frameworks.

The practical implication is that environmental planning can't be an afterthought. Successful projects integrate environmental considerations from the earliest design stages. This means "zero-footprint" construction techniques where feasible, comprehensive waste management plans, detailed wildlife protection protocols, and genuine engagement with affected communities long before construction begins.

Danish engineering firms that excel in low-impact construction have a clear advantage here. Modular buildings that can be completely removed without leaving permanent marks on the landscape, closed-loop water systems that don't discharge into pristine fjords, renewable energy systems that eliminate diesel generators—these aren't just environmental nice-to-haves in Greenland. They're often licensing requirements, and they're certainly competitive advantages when seeking both regulatory approval and social license.

Case Study: The Disko Bay Wind-Hydro Hybrid

Let's ground all this theory in a real example that illustrates how successful Danish-Greenlandic energy partnerships work in practice. The Disko Bay Hybrid project, which became fully operational in late 2025, is emerging as the model for Arctic renewable integration.

The project combines 50 megawatts of onshore wind capacity with a 20-megawatt pumped-hydro storage system, serving three major towns in the Disko Bay region. On paper, it's straightforward. In practice, it required solving a series of challenges that are now informing projects across the Arctic.

The wind turbines are Vestas Arctic-specification units, designed to operate in temperatures down to minus 30 Celsius with special cold-weather packages that include heated nacelles, de-icing systems, and modified lubricants. These aren't standard turbines with a few tweaks—they're specifically engineered for polar conditions, and Vestas developed much of this technology for Danish Antarctic research stations before adapting it for commercial use.

The pumped-hydro component is particularly clever. During periods of high wind production and low demand, excess electricity pumps water from a lower reservoir to an upper reservoir, storing energy as gravitational potential. When the wind drops or demand spikes, the water flows back down through turbines, generating electricity. This addresses one of the fundamental challenges of Arctic renewable energy: the massive seasonal and daily variation in both generation and demand.

NIRAS, the Danish engineering consultancy, handled the civil works—no small feat in permafrost conditions where traditional construction techniques often fail. The company used specialized techniques including thermosiphons (passive cooling systems that keep foundations frozen) and flexible mounting systems that can accommodate ground movement as permafrost thaws and refreezes seasonally.

The financing came through EIFO, Denmark's export credit agency, which provided loan guarantees that made commercial lending viable. Without these guarantees, the project's perceived risk would have required prohibitively expensive debt financing. With them, the project accessed competitive interest rates, making the economics work.

The results have exceeded expectations. The three towns served by the project have completely eliminated diesel generation, saving the Greenlandic treasury millions in annual fuel subsidies. Carbon emissions from electricity generation in the region have dropped to essentially zero. Local air quality has improved dramatically—diesel generators produce significant particulate pollution that affects community health.

Perhaps most importantly, the project has created a blueprint that's now being applied to other Greenlandic communities. The combination of wind, hydro storage, and smart grid control systems is proving to be the optimal architecture for Arctic renewable energy, and Danish companies have established themselves as the leaders in deploying it.

Strategic Opportunities for Danish Businesses in 2026

We've covered a lot of ground—geopolitics, technology, resources, infrastructure, regulation. Let's bring it together with concrete strategic guidance for Danish companies looking at Greenlandic opportunities.

The "Arctic-Danish Joint Venture" Model

The most successful projects in 2026 are structured as genuine joint ventures between Danish technical expertise and Greenlandic partners, often facilitated through Grønlands Erhverv (the Greenland Business Association). This isn't just about ticking regulatory boxes; it's about combining complementary strengths.

Danish firms bring proven Arctic technology, access to European capital markets, connections to end-market customers, and decades of engineering experience. Greenlandic partners bring local knowledge, community relationships, understanding of political dynamics, and increasingly, skilled workers trained through Danish-Greenlandic educational partnerships.

The most successful JVs have clear governance structures with genuine Greenlandic decision-making authority, transparent benefit-sharing arrangements, and explicit commitments to technology and skills transfer. They're structured to eventually transition to majority Greenlandic ownership as local capacity develops. This long-term partnership approach builds trust and creates projects that survive political changes and economic cycles.

Leveraging EIFO and European Financial Architecture

Danish companies have access to financial tools that many international competitors lack, and failing to use these tools puts you at a disadvantage.

The Export and Investment Fund of Denmark (EIFO) has created a specific "Arctic Window" in 2026 with the explicit goal of supporting Danish companies competing against American and Chinese firms with their own state-backed financing. EIFO can provide loan guarantees, direct lending, or equity investments that dramatically improve project economics.

The key is early engagement. EIFO involvement works best when the agency is brought in during project structuring, not after financing has already been attempted through commercial channels and failed. Their expertise in Arctic project risk assessment can actually improve project design, making ventures more likely to succeed regardless of who ultimately provides the financing.

Danish SMEs in the energy supply chain should particularly focus on EIFO's de-risking guarantees when bidding on the upcoming hydropower tenders. These guarantees can cover various risks—political risk, payment default, currency fluctuations—that make Arctic projects seem too risky for purely commercial financing but are manageable with the right risk-sharing structure.

Beyond EIFO, the European Investment Bank and the Nordic Investment Bank are both actively seeking high-quality Arctic projects that align with European climate and security goals. Danish companies with strong Greenlandic partnerships and solid ESG frameworks can access this capital at rates that make ambitious projects viable.

Sustainability as Competitive Differentiation

Here's where Danish companies have perhaps their strongest advantage: the ability to execute large projects with minimal environmental footprint. With the world watching Greenland's ice sheet melt and with environmental scrutiny at unprecedented levels, "clean" execution isn't just ethically preferable—it's a genuine competitive advantage.

Danish firms that excel in low-impact engineering—modular construction that leaves no permanent footprint, closed-loop industrial processes with zero discharge, renewable energy systems that eliminate diesel dependence, waste recycling and circular economy approaches—consistently win bids over competitors with slightly lower quoted prices but conventional construction methods.

The reason is simple: Greenlandic authorities and communities have learned from hard experience that the cheapest bid often becomes the most expensive project when environmental problems emerge mid-construction, triggering delays, penalties, and political opposition. Danish firms with proven track records of clean execution in harsh environments are increasingly seen as lower risk, even if their initial bids are somewhat higher.

This sustainability focus also helps with European end-market access. Products manufactured in Greenland using Danish clean technology can be marketed with compelling sustainability stories that command premium prices and preferential access to ESG-focused supply chains.

Looking Forward: The 2026-2030 Trajectory

As we move through 2026 and toward the end of the decade, several trajectories seem clear for Greenland and for Danish involvement in Greenlandic development.

First, the scale of energy projects will continue to increase. The Tasersiaq and Tarsartuup Tasersua hydropower tenders represent just the beginning. If these projects prove successful, additional sites will be developed, potentially reaching the multi-gigawatt scale by 2030. This creates sustained demand for Danish engineering services, equipment supply, and operational expertise spanning decades.

Second, the Power-to-X sector will likely see at least one major commercial-scale project reach operation by 2028-2029. The economics are approaching viability, the technology is proven, and the market for green marine fuels is developing faster than many expected. Danish companies that establish themselves early in this value chain—whether in electrolyzer supply, ammonia production, or marine bunkering logistics—position themselves for long-term growth as the market scales.

Third, critical minerals development will accelerate. Tanbreez will likely be in production by 2028 if American financing materializes. Malmbjerg could follow within a few years if molybdenum prices remain strong. Additional rare earth, graphite, and specialty mineral projects will advance through exploration and feasibility stages. Danish firms with relevant mining services, processing expertise, or logistics capabilities should be positioning themselves now for opportunities that will materialize in the late 2020s.

Fourth, the political relationship between Nuuk and Copenhagen will continue evolving. Full Greenlandic independence remains a long-term aspiration for many Greenlanders, but the timeline and pathway remain uncertain. What seems clear is that the relationship will become increasingly transactional and less based on historical ties. Danish companies and the Danish government that approach Greenland as equal partners rather than dependent territories will thrive. Those clinging to outdated models will struggle.

Fifth, geopolitical competition for Arctic influence will intensify rather than diminish. The Trump administration's interest in Greenland is unlikely to be a passing phase; it reflects genuine American strategic concerns about critical mineral security and Arctic access. Chinese interest will persist for similar reasons. This creates ongoing complexity but also ensures that Greenland remains a high-priority region for Western investment and support—an environment where Danish firms with the right capabilities can succeed.

The Final Word: Greenland Is No Longer the Future—It's the Present

For decades, Greenland has been described as a land of future potential—vast resources that will someday be developed, renewable energy that could eventually power industries, minerals that might break Chinese monopolies. That future is now.

The hydropower tenders are open. The airports are operational. The fiber optic cables are laid. The mining licenses are being granted. The geopolitical focus is intense. The investment capital is available. The regulatory frameworks are established. The technology is proven.

Danish companies face a choice in 2026: engage with Greenland as the strategic priority it has become, or watch as American, Canadian, Australian, and Chinese firms claim the opportunities that geography and history have positioned Denmark to lead.

The Arctic is no longer a future opportunity; it's a present mandate. The companies and the countries that recognize this reality and act on it now will shape the next generation of global energy and resource supply chains. Those that wait for the situation to "settle" will find themselves spectators rather than participants in one of the most significant economic and geopolitical transformations of the 21st century.

For the Danish energy sector, the message is unambiguous: Greenland isn't a side project or a speculative venture anymore. It's central to European energy security, critical to the green transition, and essential to Denmark's strategic position in a rapidly changing world. The question isn't whether to engage—it's how quickly and how effectively you can build the partnerships, develop the expertise, and deploy the capital to seize what may be the opportunity of a generation.

Use buttons or copy text to share